All Categories

Featured

Table of Contents

In spite of being recognized, all capitalists still require to perform their due persistance throughout the process of investing. Accredited capitalists can access our selection of vetted investment possibilities.

With over $1.1 billion in safety and securities sold, the management team at 1031 Crowdfunding has experience with a vast array of investment frameworks. To access our full offerings, register for a financier account.

Accredited's workplace culture has typically been We think in leaning in to support enhancing the lives of our colleagues in the very same method we ask each various other to lean in to passionately support improving the lives of our clients and area. We give by offering means for our group to rest and re-energize.

Top Alternative Investments For Accredited Investors

We additionally supply up to Our wonderfully assigned structure includes a health and fitness space, Rest & Leisure spaces, and technology created to support versatile offices. Our finest concepts originate from working together with each various other, whether in the workplace or working remotely. Our aggressive financial investments in modern technology have allowed us to create an allowing staff to add anywhere they are.

If you have a rate of interest and feel you would be a great fit, we would certainly love to connect. Please inquire at.

Experienced Investments For Accredited Investors – Philadelphia

Approved financiers (occasionally called competent capitalists) have access to investments that aren't readily available to the general public. These financial investments might be hedge funds, tough money fundings, convertible financial investments, or any type of other safety and security that isn't signed up with the economic authorities. In this write-up, we're mosting likely to focus specifically on actual estate financial investment options for certified capitalists.

This is whatever you require to learn about property investing for accredited investors (investments for accredited investors). While anyone can spend in well-regulated protections like stocks, bonds, treasury notes, common funds, etc, the SEC is concerned regarding typical capitalists obtaining right into investments beyond their methods or understanding. So, as opposed to enabling any individual to purchase anything, the SEC produced an accredited financier requirement.

In extremely basic terms, uncontrolled securities are believed to have higher threats and higher rewards than managed financial investment automobiles. It is very important to keep in mind that SEC policies for recognized investors are designed to safeguard financiers. Unregulated protections can supply phenomenal returns, yet they additionally have the possible to produce losses. Without oversight from economic regulatory authorities, the SEC simply can not assess the risk and benefit of these financial investments, so they can't supply details to enlighten the average capitalist.

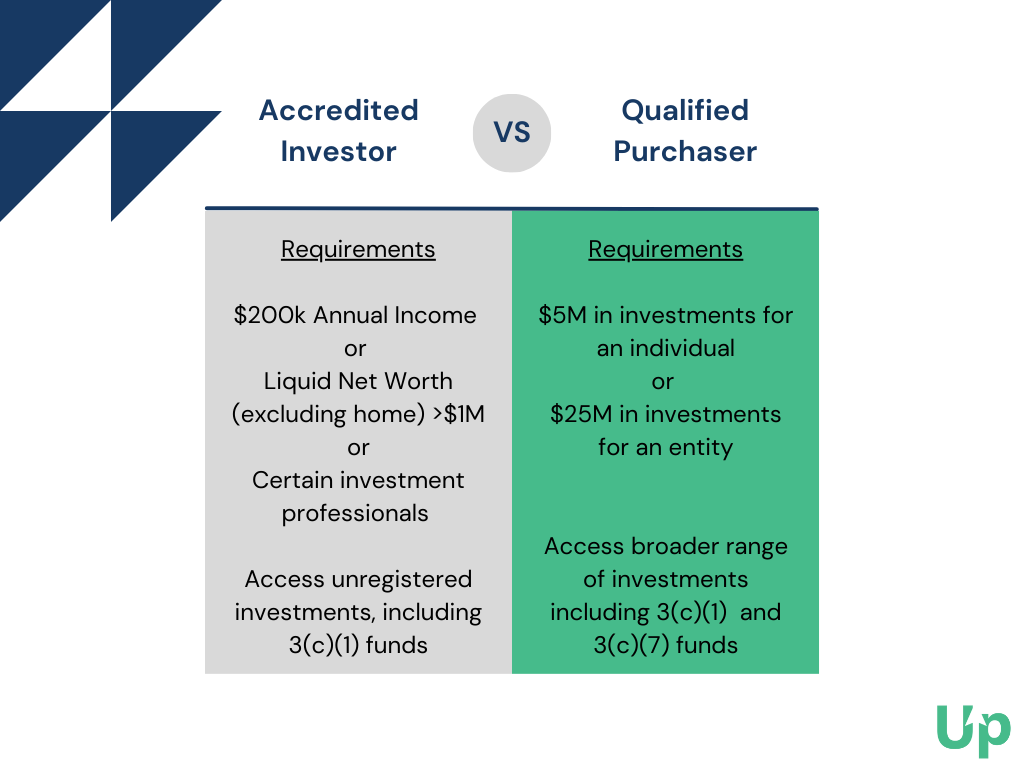

The concept is that investors that make enough earnings or have enough wealth are able to take in the risk far better than financiers with reduced revenue or less wide range. As an accredited financier, you are anticipated to finish your very own due persistance prior to adding any possession to your financial investment profile. As long as you satisfy one of the complying with four needs, you qualify as a recognized financier: You have earned $200,000 or more in gross earnings as a specific, each year, for the past 2 years.

Innovative Secure Investments For Accredited Investors – Philadelphia

You and your spouse have had a consolidated gross earnings of $300,000 or more, each year, for the past two years. And you anticipate this level of income to proceed. You have a total assets of $1 million or more, excluding the worth of your main residence. This implies that all your properties minus all your debts (omitting the home you live in) overall over $1 million.

Or all equity proprietors in the business certify as recognized capitalists. Being a recognized capitalist opens up doors to financial investment opportunities that you can't access otherwise. As soon as you're approved, you have the alternative to spend in unregulated protections, which consists of some outstanding investment possibilities in the property market. There is a variety of real estate investing strategies available to capitalists who do not currently meet the SEC's needs for certification.

Tailored Investment Opportunities For Accredited Investors

Becoming a recognized financier is simply an issue of confirming that you satisfy the SEC's needs. To confirm your earnings, you can give paperwork like: Revenue tax returns for the previous two years, Pay stubs for the past two years, or W2s for the past 2 years. To confirm your total assets, you can offer your account statements for all your assets and responsibilities, consisting of: Financial savings and checking accounts, Investment accounts, Exceptional lendings, And genuine estate holdings.

You can have your lawyer or CPA draft a confirmation letter, confirming that they have reviewed your financials which you satisfy the needs for a recognized investor. But it might be more affordable to utilize a solution specifically created to confirm certified investor standings, such as EarlyIQ or .

Specialist Accredited Investor Opportunities Near Me (Philadelphia)

For instance, if you register with the realty financial investment firm, Gatsby Investment, your recognized investor application will certainly be processed through VerifyInvestor.com at no charge to you. The terms angel capitalists, sophisticated investors, and accredited financiers are typically made use of reciprocally, but there are refined differences. Angel investors offer seed money for startups and tiny businesses for possession equity in business.

Typically, any person that is recognized is presumed to be an innovative investor. The income/net worth demands remain the very same for foreign capitalists.

Right here are the most effective financial investment opportunities for recognized capitalists in actual estate. is when investors pool their funds to acquire or restore a building, then share in the profits. Crowdfunding has turned into one of the most popular techniques of purchasing property online given that the JOBS Act of 2012 enabled crowdfunding systems to use shares of realty jobs to the general public.

Some crowdfunded property investments don't require certification, however the projects with the best potential rewards are typically booked for accredited financiers. The difference in between jobs that approve non-accredited financiers and those that only approve certified capitalists generally comes down to the minimum investment amount. The SEC presently limits non-accredited capitalists, who make less than $107,000 per year) to $2,200 (or 5% of your annual income or total assets, whichever is less, if that quantity is greater than $2,200) of investment resources annually.

Latest Posts

Tax Lien Certificates Investing Risks

How To Find Delinquent Property Tax List

Delinquent Property Tax List